Recent Posts of Budget

08 April, 2015

Despite losing in the platform wars, Microsoft’s developer ecosystem is still strong and they’re not showing much sign of wanting to give up their tools. The latest Developer Economics survey showed that 38% of mobile developers were using C# for some of their work and 16% use it as their main language. Those developers are not all focused on Microsoft platforms by a long way. So what are they doing?

23 December, 2014

In our latest report, App Economy Forecasts 2015 – 2017, we estimate the number of mobile developers in 2014 at 5.5 million. Demand for mobile development skills has never been higher and yet revenue from app store sales cannot possibly pay their salaries.

08 July, 2014

HTML5 and the latest standard web technologies have finally driven the developer community towards a cross-platform app and game deployment scenario. Still, there are some challenges that have to be solved in order to smooth the experience of getting a final product to the increasing number of markets, from fragmented platforms to performance issues or ways to access specific features of each target in a cross-platform way. This article provides an overview of the most common challenges and some tips and technologies available today in order to overcome them.

19 February, 2014

Why did Flappy Bird become a flappy Icarus, crashing after flying too close to the sun, and not a new Rovio? In truth, Nguyen and Rovio represent very different groups of developers. Their motivations are not at all alike, and so neither is their behavior.

13 January, 2014

Revenues from Android apps saw tremendous growth in 2013. If you look at the headline global figures then revenues from Android apps on Google Play are rapidly closing on those from iOS apps on the App Store. It looks extremely likely that 2014 is the year that Android will overtake iOS in total app revenues. However, dig a little deeper and you’ll find the distribution of revenues, both geographically and across apps is rather different. If you’re planning your platform strategy for this year then a dive into the details might prove invaluable.

24 December, 2013

In an earlier post we showed how enterprise app developers make 4 times the revenue of those developing consumer apps on average. Targeting enterprises with apps can be very different from building consumer apps and not all developers prioritise revenue, so it’s not for everyone.

Do you want the indie developer lifestyle, or to build a company? What sort of contact do you want to have with your customers? Do you like consulting work or do you prefer to build your own products full time? Do you have a strong development platform preference? Depending on your answers to these questions you might find one of the 4 reasons below keeps you focussed on consumer apps for the foreseeable future.

16 December, 2013

Consumer apps are the focus for all the excitement and media attention in the industry. Enterprise software is dull and boring, right? Not if you care about making money! Besides, what’s so dreary about reinventing the way people work in a mobile and connected world?

“Wait”, I hear you cry, “what about BYOD and the consumerization of IT? Surely the future is all about selling computing tools directly to professionals?” Well the data from our last Developer Economics survey says that future isn’t here yet. In any case, if you’re going to collaborate with colleagues then you all need to be using the same tools, so most of the time the company still has to choose and buy them.

We asked developers which type of customer they primarily targeted from a selection of Consumers, Professionals, Enterprises, Other and Not Sure. Using this data we can compare the fortunes of developers serving each of those audiences.

23 November, 2013

Although the debate on HTML5 versus native apps seems to be favouring native apps currently, particularly in terms of user experience and performance, average developer revenues tell a very different story. Our survey data shows the mean average revenue for developers who consider HTML5 for mobile devices their primary platform is the highest of all platforms, just over twice that of the next nearest (iOS)*. However, the rewards are very unevenly shared, with the median average revenue for the same developers under half that of their iOS counterparts. Diving into the data we can see significant differences in revenue depending on how mobile apps built with web technologies are delivered to users and the categories they target. Understanding these differences could improve your chances of succeeding with HTML5.

19 November, 2013

The most popular revenue models appear to be those that are easiest to implement. The developers using them tend to have lower revenues. This may be due to greater competition or it might just be a result of less sophisticated app businesses producing less valuable apps. There are some interesting differences between platforms but subscriptions appear to be a relatively untapped gold mine everywhere, although maybe not for everyone.

12 November, 2013

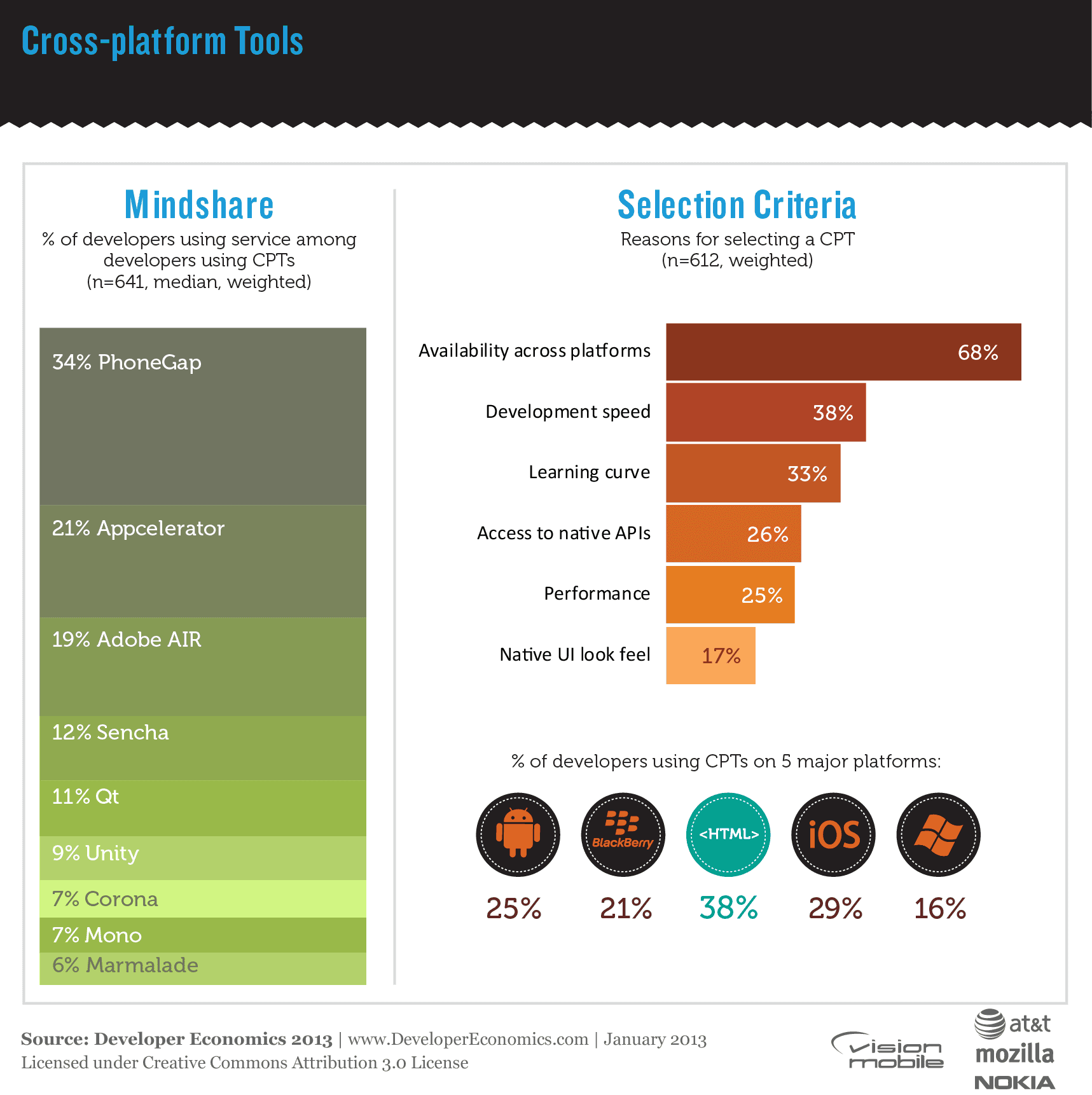

As the market temperature for cross-platform tools (CPTs) continues its steep climb into hotter territory, it’s understandable why many feel we are witnessing a mobile fragmentation that is perhaps much larger and more significant than the recent wars waged over the desktop. If this fragmentation tells us anything, it’s that [tweetable]cross-platform tools for mobile development […]