April 17, 2013

Advertising is the most popular developer service

Among those developer services that we benchmarked the most popular is ad networks and exchanges, reflecting the widespread popularity of advertising as a revenue model. Advertising is the most popular revenue model, while ads can also act as a promotion channel that facilitates app discovery.

With advertising being the most widely used revenue model among developers, advertising services attract considerable developer interest taking the top spot among the developer tools that we benchmarked. Providers of ad services monetise their service by taking a direct cut of advertising revenue generated by developers. With 100+ ad networks and exchanges, there is intense competition, regional specialisation and niche solutions. In spite of this, several ad services are not profitable.

The services we benchmarked are either advertising networks that provide direct access to their own pool of ads or ad exchanges (aka mediation engines, not real-time bidding exchanges) that act as aggregators, automating access to a large number of individual ad networks. Ad exchanges offer some flexibility to developers by allowing them to select between multiple ad networks through a single SDK – offering better fill rates and eCPMs. At the same time, ad network SDKs often provide access to more features available, than the generic features available through an ad exchange.

Ad services are most popular with Windows Phone and Android developers

Among developers using Ad services, 27% use an exchange, however, just 16% utilise an ad exchange as their primary ad platform. Most developers using ad services use just one service (61%), 25% use two services and 14% use three or more services. Overall, developers use 1.59 services on average. There is quite a large variance in the number of developers using ad services depending on the scale of development: those developing less than 5 apps per year tend to use ad-services much less than those developing more than 5 apps per year. Among developers that develop more than 16 apps per year, most likely working for large publishing houses, software services companies or agencies, about 60% use ad services in their apps.

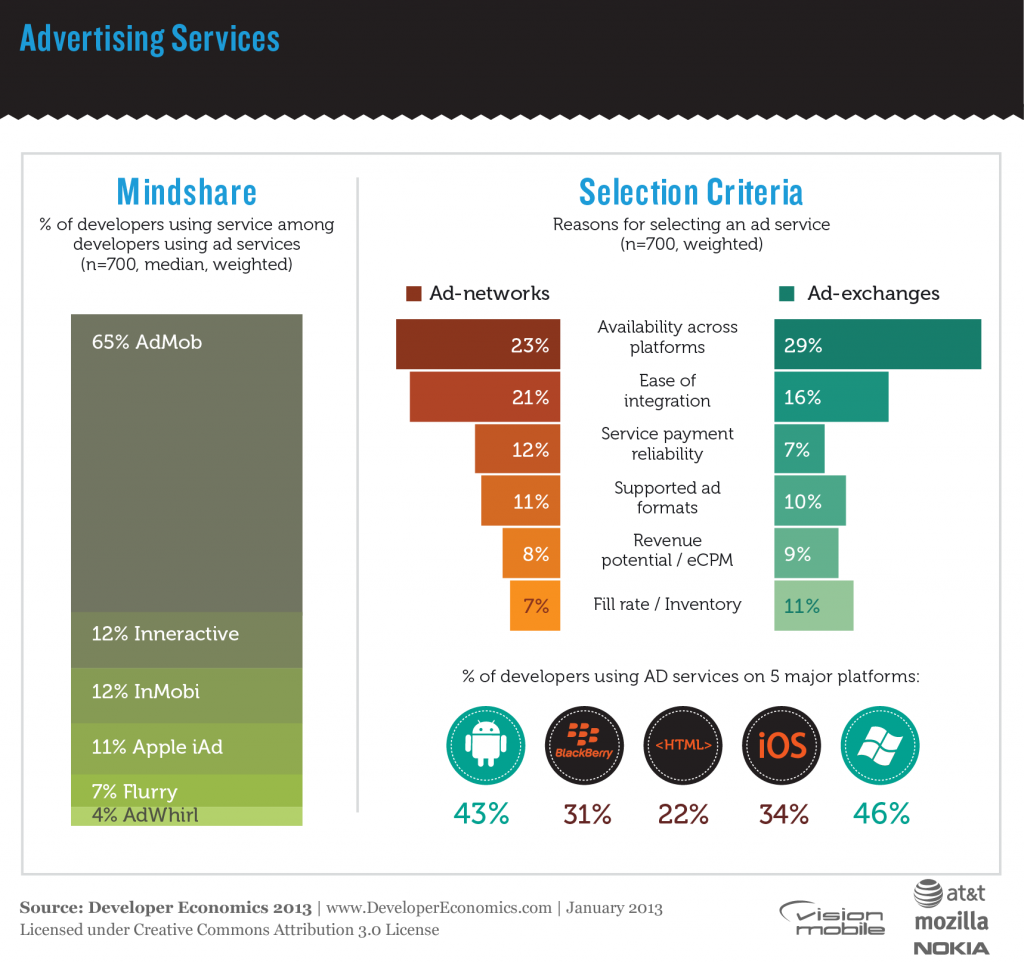

Ad services are most popular with those who develop primarily on Windows Phone and Android (46% of WP developers and 43% of Android developers), and less so on iOS and BlackBerry (35% and 31% respectively). This is in agreement with our findings on revenue models being used on each platform, with developers on Android and Windows Phone relying heavily on advertising to monetize their apps.

AdMob dominates ad networks (65%) and Inneractive leads among ad exchanges (12%)

AdMob, a service acquired by Google in 2010 is clearly the dominant platform in mobile ad services, adopted by 65% of developers that use ad services. AdMob has recently expanded to ad exchange services, a move that aims to counter the threat that ad exchanges pose for Google. Second runners, each used by 12% of developers, are Inneractive, an ad-exchange/mediation service and InMobi, an ad network growing out of India to become a major player in emerging markets: InMobi’s mindshare is 17% in Asia and 33% in Africa. Apple’s iAd service comes fourth overall with 11%, and despite being quite popular among iOS developers, AdMob is the leading ad service on iOS, used by 66% of iOS developers that we surveyed.

Ad exchanges are complementary to ad networks. For example, developers will use one service with high eCPM but low fill rate and another with lower eCPM but nearly 100% fill to plug the gaps in the better paying service. When selecting an ad network or exchange, availability across platforms comes on top in both cases. Ease of integration is also very important, particularly so for developers using ad networks. Supported ad formats, revenue potential and fill rate are secondary selection criteria, and therefore differentiation factors across advertising services.

[toggle title=”Important things to know about this interactive graph”]

- All the filters in the graph refer to survey questions in which respondents could select multiple answers. This means that there is no direct link between the filter and the use of the tool. For example, filtering on “Android” means that the respondents develop Android apps. It doesn’t imply that they use the tools for their Android apps specifically, or even that the tool supports the Android platform. Use filters as a guideline only.

- Keep an eye on the sample size. If the sample size is low, the graph doesn’t offer strong conclusions about the popularity of different tools. Use your good judgment when making decisions.[/toggle]

Find the best ad service for you!

[sectors slugs=’ad-networks-exchanges’]

Recent Posts

August 27, 2025

How to Find the Right Learning Path When You’re Switching to a Tech Career

See post

August 27, 2025

The Hidden Challenges in Software Development Projects: Key Insights from Our Latest Survey

See post

August 22, 2025

Developer News This Week: AI Speed Trap, GitHub Copilot Agents, iOS 26 Beta Updates & More (Aug 22, 2025)

See post